Chances are you don’t have the sewer in mind when you are looking at houses. I like to say three strikes and you are out! When you see a home and fall in love psychology dictates that you try to come up with 3 reasons not to buy. If you find them the house is out. But have you really made the list of pros and cons in terms of future costs of home ownership? In the final decision, these are super important things to consider.

1. Healthy bones: roof, foundation, windows, plumbing, electrical and HVAC

I always start with water as it is the most problematical in causing problems. Standing water , water damage, roof leaking, windows leaking and leaky plumbing either inflow or outflow. Sewer lines are the least inspected item so make sure that at minimum you ask whether a seller has had back ups into the house or roto rooter bills. A camera in older homes may be advisable. Inspectors can not often discuss smells but you should think about them as they often mean hidden water problems. These are not to be put on the wish list of when we get around to it. These are immediate concerns. The next is the electrical – old 100 amp panels suddenly set upon by all our gadget and a larger family are not only immediate costs but can be dangerous. The heater how does it function and how old it it ? Is it “coiled” for AC add on if not installed. Do the windows open easily – if so maybe you can wait for the new Milgards. Or do they forecast a hidden foundation problem.

2. Healthy muscle:

Beautiful bathrooms and kitchens are valuable – they cost money and make a mess when redone- something you can not easily do with little children around. Ugly carpeting and wild paint colors attract a lot of attention, but those can be easy, and relatively inexpensive fixes. And a house that’s perfect except that it needs a total kitchen remodel might not be as perfect as it seems. A kitchen remodel averages more than $20,000—and can get much higher very easily and that does not include appliances. Before making an offer on a fixer-upper house, make sure the price, plus any obvious renovations on your checklist will fit your budget.

3. No health hazards

Older homes are charming but mold, asbestos, and lead paint aren’t. These are major issues to look for when buying a house. A home inspection won’t necessarily point out mold and asbestos-prone materials, so it’s up to you to get them professionally tested. Remediation is really expensive and not fun. Cottage cheese ceilings, older siding and heater flues may contain asbestos. The test is about $30 and takes 1 day. There are even home lead tests. So don’t break the deal but don’t break the bank either. Know before you buy.

4. Clean insurance history

Ask a seller or your new fire insurance carrier whether the sellers have had insurance claims that have been filed on the house in the past five years. It is no longer a requirement to ask the seller to provide a Comprehensive Loss Underwriting Exchange, or C.L.U.E. report but your insurance agent will do it anyway. If the sellers have forgotten to disclose it , you might be denied insurance so ask early. You might look at that new kitchen flooring differently if you learn it was added after paid out water damage.

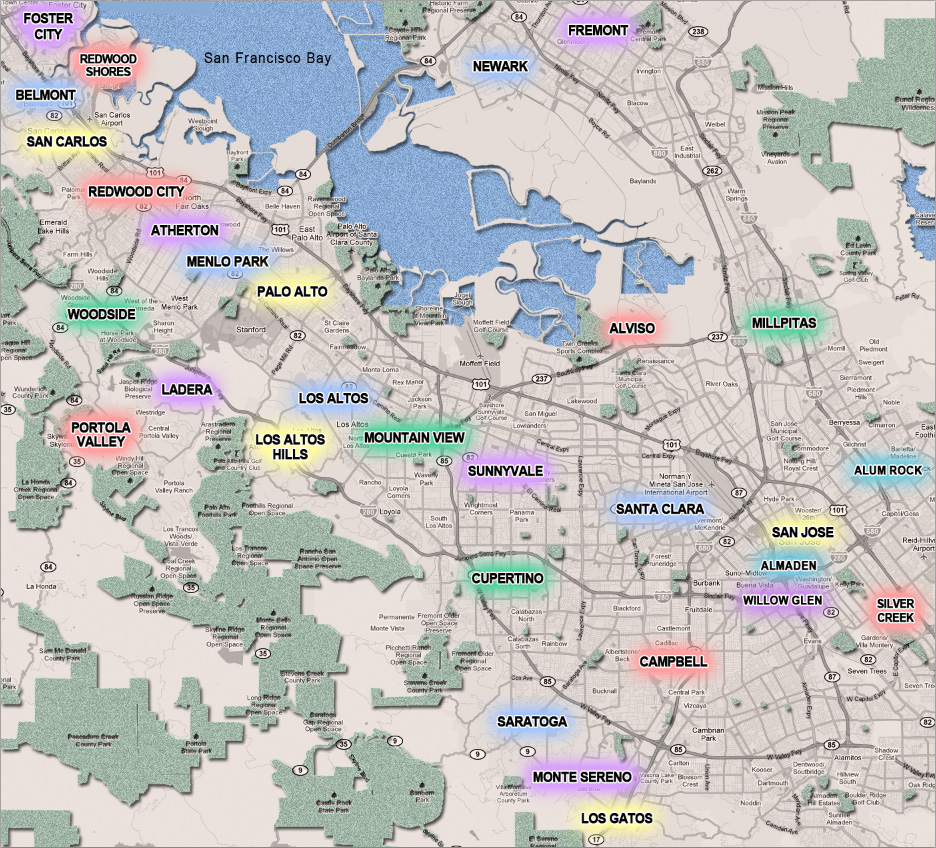

5. Location and is it the right neighborhood

Last but certainly not least. Did you know that I can run the socio demographics and financial qualifications of your future neighbors in 5 minutes? You might not want to knock on their door before you buy but let me do the sleuthing for you. Your ideal home could end up being a nightmare if you are next to a deadbeat. There are loads of resources : crime statistics , school scores, sales and occupancy rate and that big natural hazard disclosure report that you really don’t want to read — learn how to scan it properly to find hidden neighborhood nuisances like super fund sites or new developments.

Call me for more info or email me here