California real estate is a better investment than the stock market. It has appreciated consistently at around 4% or more in good areas. Schools, proximity to jobs, amenities, neighborhood consistency, and the quality of the home make up the evaluation of a home’s true value. Plus there is the huge added benefit of having a place you can call your own. Here are the factors to consider

-

It’s in a great location.

- An up-and-coming neighborhood

- A neighborhood in a top school district and nearby local schools

- An area scheduled for serious development, such as being newly connected to city infrastructure or planned housing developments

- an area where competitive homes are not being built because there is a shortage of land

-

It’s a smaller home.

You may have heard buy the smallest home in the best neighborhood and it will appreciate more. The percentage increase in appreciation of a small home will be higher than a larger home. Two homes in the same neighborhood on similar plots of land are likely to appreciate by the same amount. That amount will be a larger percentage of a less-expensive structure, so that means more appreciation. In line with that is that the SF value of a smaller home is higher than a larger home in the neighborhood in part because the plumbed areas are the most expensive parts of a home. This means that a 2000 SF home with 3 bed 2 bath will often be a lower $/SF value than a 1600 $/SF value also with 3 bed 2 bath.

-

Land value is important to consider.

Land appreciates more reliably than the buildings on it. It makes sense because buildings age and get run down, and land doesn’t. That’s why certain types of properties—like waterfront or view property —tend to have better home appreciation, as long as the structure is sound.

-

The home could use a bit of work.

The important words here are “a bit.” House flipping is a risky business, because major fixer-uppers often come with surprises and costs not clearly identified in a series of property inspections provided by a listing agent. But homes that need a moderate amount of work that can be done over time tend to rack up a better return on investment for homeowners. A new construction home, on the other hand, will come to you in top shape, so it doesn’t leave as much room for improvement and is generally sold at a premium. Thinking about maximizing your returns? While some fixer-uppers are a gamble, it’s possible to find homes in need of serious work that turn out to be a great deal.

-

Think outside the box.

Look for homes that might get you into a location at a lower cost but not with permanent deterrents like busy streets and really poor floorplans. Look at 3 bedroom 1 baths where there is a place to add a bath or 4 bedrooms that are too small where you can remove a wall and create a more appealing 3 bedroom home.

-

The local housing market is strong.

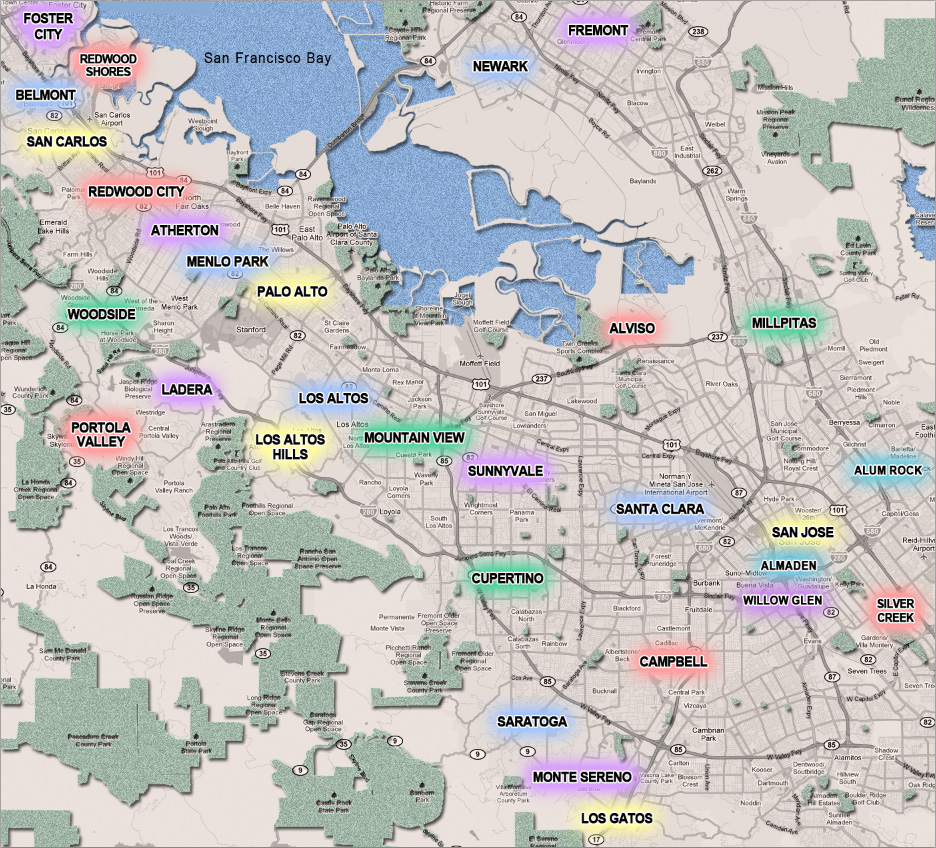

Even the bay area housing market has cooled off and in 2019 its a tricky market to evaluate. Demand is high but prices are higher. All the factors discussed here are even more critical than in prior years. Look for neighborhoods with strong, stable markets during the last recession and areas that had low foreclosure rates. These places are often close to large, dependable employers, or colleges.

Finally use me to weight in all these factors and make a good determination on purchase